How Coinbase Phishers Steal One-Time Passwords

Krebs on Security

OCTOBER 13, 2021

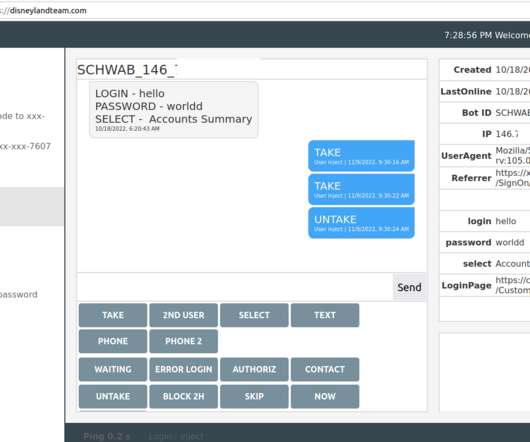

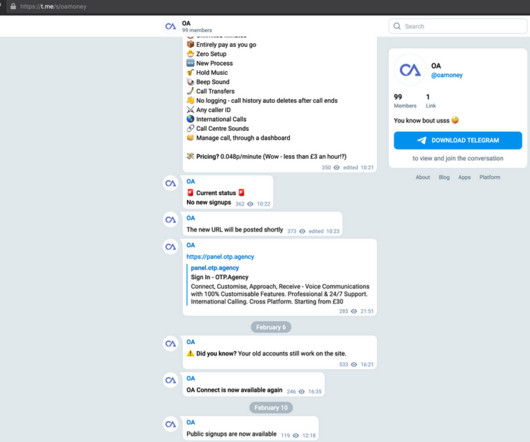

A recent phishing campaign targeting Coinbase users shows thieves are getting cleverer about phishing one-time passwords (OTPs) needed to complete the login process. A Google-translated version of the now-defunct Coinbase phishing site, coinbase.com.password-reset[.]com. The Coinbase phishing panel.

Let's personalize your content