The Risk of Weak Online Banking Passwords

Krebs on Security

AUGUST 5, 2019

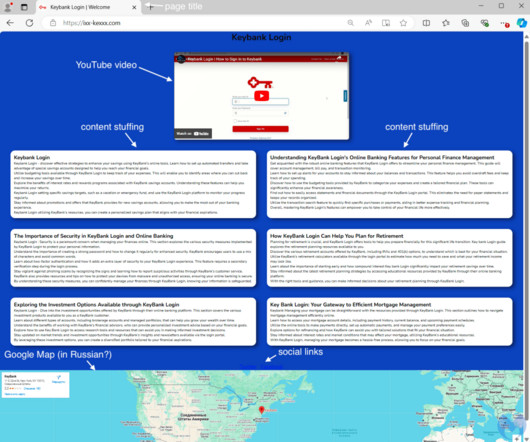

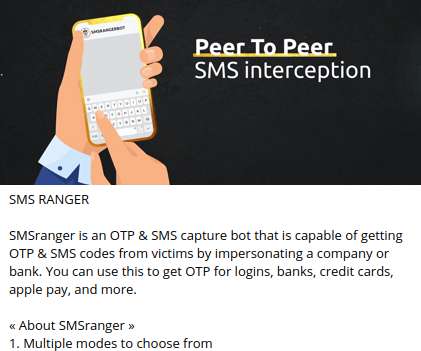

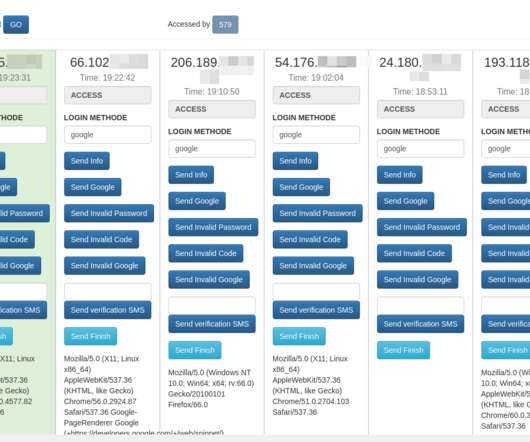

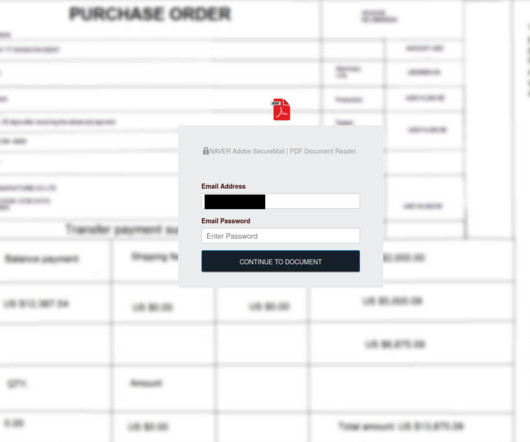

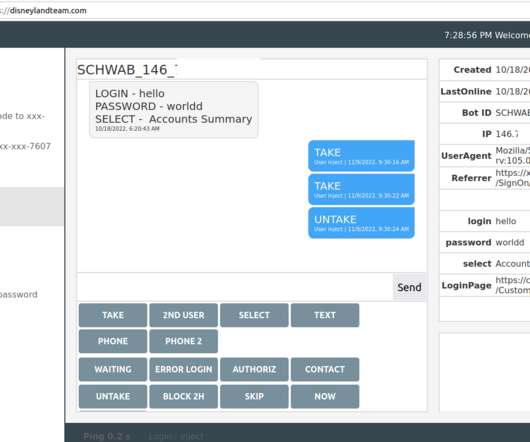

If you bank online and choose weak or re-used passwords, there’s a decent chance your account could be pilfered by cyberthieves — even if your bank offers multi-factor authentication as part of its login process. Image: Hold Security.

Let's personalize your content