Protecting Yourself from Identity Theft

Schneier on Security

MAY 6, 2019

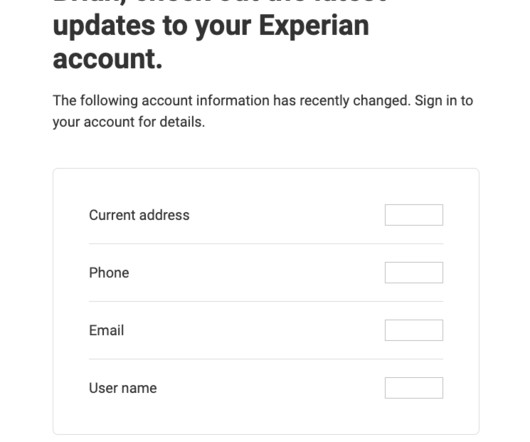

Enable two-factor authentication for all important accounts whenever possible. Do your best to disable the "secret questions" and other backup authentication mechanisms companies use when you forget your password -- those are invariably insecure. Watch your credit reports and your bank accounts for suspicious activity.

Let's personalize your content